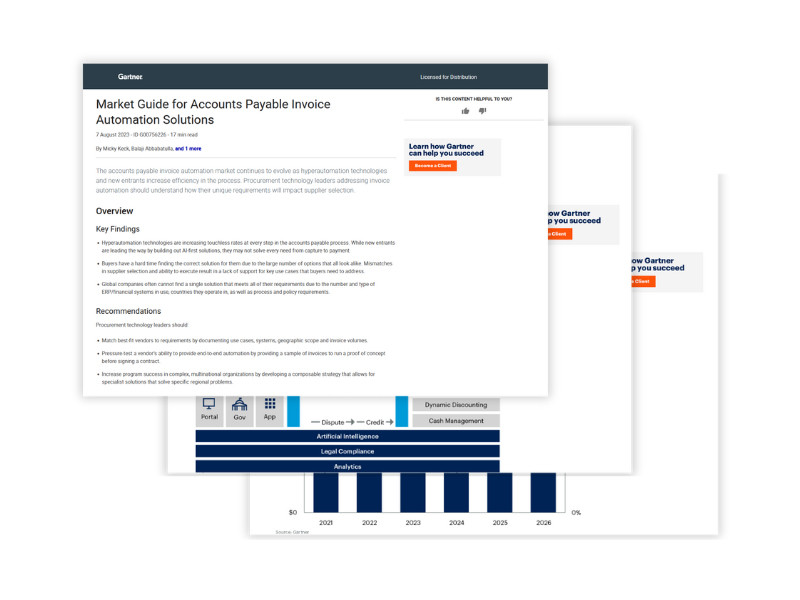

Analyst Report

Forrester Study: The Total Economic Impact™ (TEI) of Basware AP Automation

Curious about the economic impact on your organization? Download the study to take the next step towards a more efficient, cost-effective, and compliant AP process.

# Accounts Payable